Law firm specialising in employment law

and social security law.

Law firm specialising in employment law

and social security law.

You are an employer and your employee has reported an accident at work? Do you not know how to deal with the situation? Are you unaware of the risks involved in an accident at work?

Then this article is for you.

According to Article L. 411-1 of the French Social Security Code, an accident at work, whatever its cause, is any accident caused by or in the course of work to any person employed or working, in any capacity or in any place whatsoever, for one or more employers or company managers.

Case law has clarified the definition. An accident at work is defined as an accidental and sudden event or series of events (with a definite date), occurring at the time and place of work, in a relationship of subordination, resulting in a medically certified physical or psychological injury (Cass. soc., 2 Apr. 2003, n°00-21.768).

If the criteria are met, the materiality of the accident is established and the presumption of imputability applies. In principle, the health insurance fund will pay for the accident.

If one of these criteria is not met, the materiality of the accident is not established and the presumption does not apply. The fund then verifies the materiality of the accident by means of an investigation.

Employees have every interest in having their accident recognised as an accident at work.

For a start, unlike sick leave, there is no waiting period for daily benefits in the event of an accident at work.

Secondly, employees benefit from better compensation during their sick leave.

Daily benefits are paid throughout the period of incapacity for work, until the injury is fully recovered or consolidated.

Between the 1st and 28th day of sick leave, daily benefits are paid at 60% of the reference salary. From the 29th day onwards, daily benefits are increased to 80% of the reference daily salary (L.433-1, R.433-1 et R.433-3 of the Social Security Code), compared with 50% of the reference daily salary in the case of simple illness, over the entire period. Payment of compensation is subject to the fulfilment of two cumulative conditions: medically certified temporary incapacity to work and loss of earnings.

The employer is obliged to pay a minimum supplement to the daily allowance if the employee has at least one year's seniority on the date of the 1st day of absence, if the accident report was sent to the employer within 48 hours and if he or she is receiving daily allowances from the health insurance fund and is receiving treatment in France, the EEA or the EU. The employee is entitled to 90% of his gross pay for the first 30 days, then 2/3 for the following 30 days, after deduction of the daily allowance paid by the health insurance fund. Depending on seniority or applicable collective bargaining provisions, these periods and/or amounts may increase (L.1226-1, D.1226-1 et D.1226-2 of the French Labour Code).

Finally, once the occupational nature of the accident has been recognised, the health insurance fund will pay 100% of the cost of all treatment related to the accident, on the basis and within the limits of the Social Security rates, with the exception of dental prostheses and certain medical devices, which are covered at 150% on the basis of the Social Security rates and within the limits of actual costs.

The employee must inform the employer of the accident within the same day or, failing that, within 24 hours, specifying the place, the circumstances of the accident and the identity of any witnesses (L.441-1 et R.441-2 of the Social Security Code).

To facilitate this reporting, the company can set up an internal procedure indicating the people to contact (line manager, human resources, etc.), the information to provide and any internal documents to complete.

If the employee fails to send his sick leave or sends it late to the employer, he may be subject to disciplinary action up to and including dismissal (Cass. soc., 12 October 2011, n°09-68.754).

The employer must report the accident within 48 hours and by any means that provides a date certain. In practice, this is done at www.net-entreprises.fr or by CERFA (R.441-3 of the Social Security Code).

As a matter of principle, the employer must declare any accident reported to him.

Note: accidents that do not require time off work or medical treatment can only be entered in the register of minor accidents. Please note that this option is only available to certain companies that have a dedicated person on duty at all times, an emergency first-aid post and that comply with the requirements of article L.2311-2 of the French Labour Code (D.441-1 à D441-4 of the French Social Security Code). To set up this register, the CSE must be informed and the register must be declared to CARSAT.

If the employer fails to report the accident, the employee may report it himself or through one of his representatives (L.441-2 of the Social Security Code).

Failure to report the accident, or late reporting by the employer, exposes the latter to risks.

A first series of sanctions may be imposed at the initiative of the fund, namely a financial penalty imposed by the director of the CPAM (L.114-17 of the Social Security Code), reimbursement of the benefits paid by the CPAM to the worker (L.471-1 of the Social Security Code), or charging the benefits paid to the occupational injury and disease account, with a corresponding increase in the rate of occupational injury and disease contributions.

A second set of sanctions may be invoked on the employee's initiative when bringing a case before the industrial tribunal: on the one hand, as compensation for the loss resulting from the failure to report the accident, even if the employee did not report the accident himself (Cass. soc. 18 Jan 2012, n°10-15.665) and, on the other hand, for the loss of opportunity to have received compensation under the legislation on occupational injuries.

More rarely, a criminal sanction (a 4th class offence punishable by a fine of up to 750 euros) may be initiated by the public prosecutor, the fund or the insured party (by filing a complaint under R.471-3 of the Social Security Code).

Yes, the employer can contest the occupational origin of the accident by expressing reservations. By making these reservations, the employer indicates that he has doubts about the reality of the accident and its link with the employee's professional activity, and obliges the fund to open an investigation.

To do this, the employer has 10 clear days from the date of the declaration to make reasoned reservations. These can be submitted to the CPAM by post or via the website www.net-entreprises.fr.

Note that for reservations on net-entreprise, the number of characters is limited to 128. In our opinion, it is imperative to formalise the reservations on an attached document and to give adequate reasons for them.

The employer may invoke two types of grounds, in accordance with established case law on the subject.

The first relates to the circumstances of the time and place in which the accident occurred. This claim may be supported by various reasons, such as a late declaration by the employee, doubt as to the veracity of the accident, a gradual appearance of the injury or the absence of witnesses.

The second is linked to causes unrelated to work, such as a previous medical condition or the absence of an accidental event (Cass. Civ. 2e, 10 Oct. 2013, n°12-25.782).

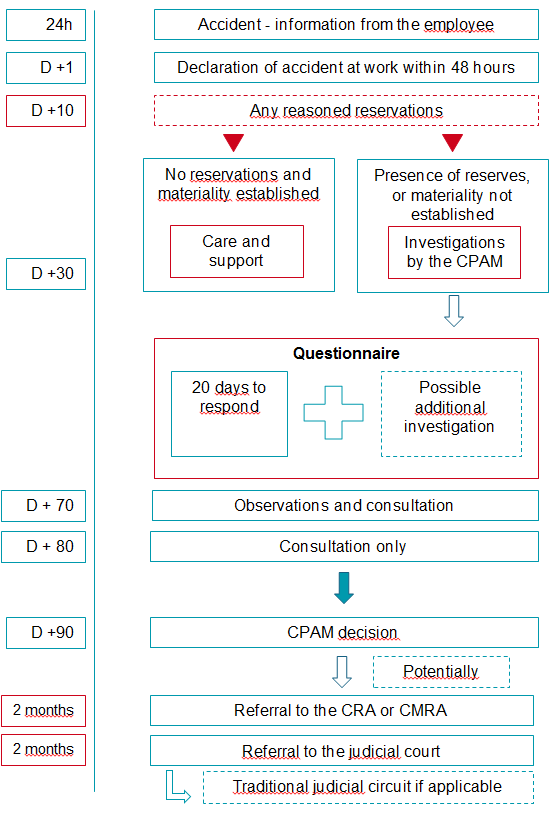

The basic procedure is governed by Articles R.441-7 and R.441-8 of the Social Security Code.

The fund has a period of 30 clear days from the date on which it receives the accident declaration and the initial medical certificate sent by the employee :

When the fund initiates investigations, it has a period of 90 clear days from the date of transmission of the complete file (declaration of accident at work and initial medical certificate) to rule on the occupational nature of the accident.

In this case, the fund sends a questionnaire on the circumstances or cause of the accident to the employer and to the victim or his representatives, within 30 clear days and by any means that confers a date of receipt. The questionnaire must be returned within 20 clear days of receipt (it is available at https ://questionnaires-risquespro.ameli.fr).

The health insurance fund may also carry out an additional investigation (this is compulsory in the event of the victim's death).

Once it has completed its investigations, and no later than 70 clear days from the date it receives the complete file, the fund makes the file available to the parties. The parties then have 10 clear days to consult the file and make their comments known, which are appended to the file. At the end of this period, the parties may consult the file for a further 10 clear days but may not make any further comments.

If you are refused reimbursement by your health insurance fund, you must appeal to the CRA or CMRA within 2 months. The CRA or CMRA then has 2 months to reach a decision.

Once this period has elapsed, and in the absence of an explicit decision, the appeal is deemed to have been implicitly rejected.

Once the prior appeal has been lodged, the insured person may refer the matter to the social section of the judicial court within 2 months if he or she has not obtained a favourable decision, and then take his or her claim to the court of appeal if necessary.

Employers can contest a decision by the health insurance fund to cover an accident at work, or the employee's inexcusable fault (when the employer is deemed to be responsible for the accident because of the exceptionally serious risks of which he could not have been unaware). It is even in the employer's interest to do so, given the impact of accidents at work on the rate of occupational injury contributions. This is because the rate of occupational injury contributions depends on the number of accidents within a company.

In the event of a refusal by the health insurance fund to cover a claim, employers wishing to contest the decision must refer the matter to the CRA or CMRA within 2 months. The CRA or CMRA then has 2 months to reach a decision.

Once this period has elapsed, and in the absence of an explicit decision, the appeal is deemed to have been implicitly rejected.

Once the prior appeal has been made, the employer may refer the matter to the social division of the judicial court within 2 months if he has not obtained a favourable decision, and then take his case to the court of appeal if necessary.

Below is a summary of the procedure for recognising an accident at work.